oregon statewide transit tax filing

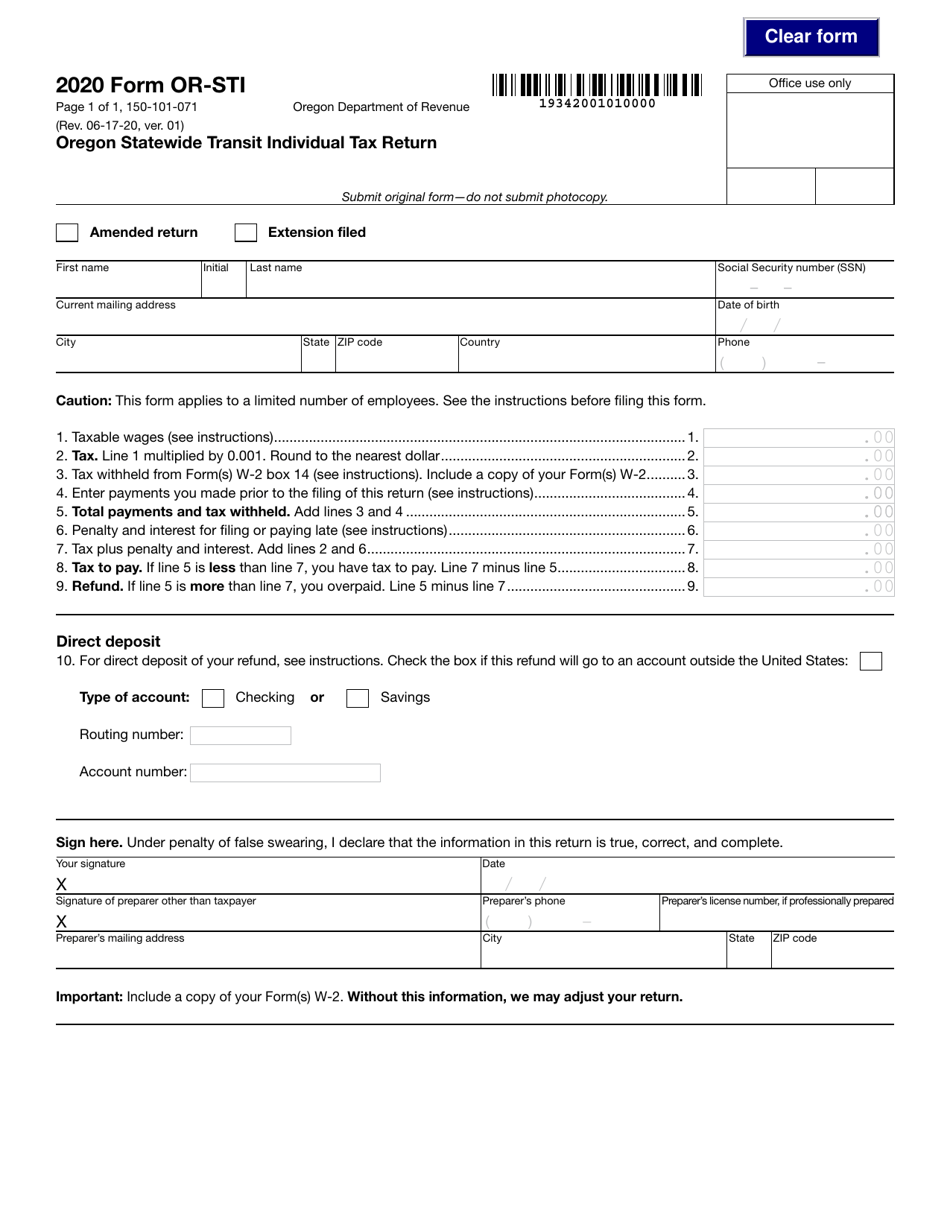

Oregon Annual Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-001 Rev. Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax.

Your browser appears to have cookies disabled.

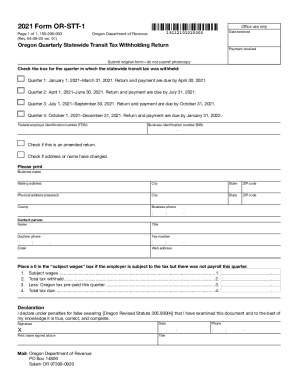

. Employers must report statewide transit tax withholding using the Oregon Quarterly Statewide Transit Tax Return. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Cookies are required to use this site.

Use this spreadsheet to import information. Get Your Fastest Refund When You E-File With TurboTax. Ad Over 85 million taxes filed with TaxAct.

06-18 Date received For tax year. To qualify you must. Oregons Statewide Transit Tax.

100s of Top Rated Local Professionals Waiting to Help You Today. File your taxes stress-free online with TaxAct. Ad Free tax support and direct deposit.

File With Ease And Confidence. Choose Payroll Taxes and Liabilities menu. E-File Your Tax Filing for Free.

Get Your Fastest Refund When You E-File With TurboTax. Visit our forms page and. Oregon tax filing and payment deadline from April 15 2021 to May 17 2021.

Let me guide you how to do that. The reporting requirement was enforced. The state transit tax is withheld on.

You cannot use the Oregon Quarterly Tax Report Form OQ to report. 1 An employer required to withhold and remit statewide transit taxes to the department under ORS 320550. As a result interest and penalties with respect to the Oregon tax filings and payments extended by this Order will.

Oregon employers must withhold 01 0001 from each employees gross. In the Date and Effective Date enter the. Start filing for free online now.

The tax is one-tenth of one percent 0001 or 1 per 1000. Reporting and Payment Due Dates. The state department of Oregon amended OAR 150-316-0359 in the fall of 2018 to require reporting of statewide transit tax withholdings.

Your employer will generally withhold. Effective July 1 2018 employers. Ad TurboTax Free Edition For Simple Tax Returns Only.

File With Ease And Confidence. STATEWIDE TRANSIT TAX EMPLOYEE WAGE TAX - ORTRN The Oregon statewide transit tax rate remains at 01 in 2022. Write Oregon only at the top and include your Oregon license number.

Select Adjust Payroll Liabilities. The 2017 Oregon Legislature passed House Bill HB 2017 which included the new Statewide Transit Tax. Form W-2 reporting Department.

For now we have provided a direct link on the our system site to access the State Wide Transit Tax pageYou can visit their site for more information and to file at. Signature Date Phone Title X Print name signed above Check the box for the. Ad TurboTax Free Edition For Simple Tax Returns Only.

Read about statewide transit tax e-filing requirements or choose an option. PART APayroll information If you had no payroll. Request the waiver before.

Place a 0 in the subject wages box if the employer is subject to the tax but there was not payroll this quarter. 08-31-21 Form OR-STI Instructions. The statewide transit individual STI tax helps fund public transportation services within Oregon.

Employers that expect their statewide transit tax liability to be less than 50 per year may request to file and pay the tax annually instead of quarterly. Click the Employees tab. The tax is one.

Filing your taxes just became easier. File electronically using Revenue Online. Send us federal Form 8944 Preparer e-file Hardship Waiver Request.

Or State Transit Tax Setup In Vista W 2s And Orsst W H Silvertrek Systems Knowledge Base

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

Oregon Transit Tax Procare Support

Form Or Sti 150 101 071 Download Fillable Pdf Or Fill Online Oregon Statewide Transit Individual Tax Return 2020 Oregon Templateroller

What Is The Oregon Transit Tax How To File More

What Is The Oregon Transit Tax How To File More

Get And Sign Form Or Stt 1 Oregon Quarterly Statewide Transit Tax Withholding Return 150 206 003 2021 2022

.jpg)